Fact 1: Since last year, the GST prevents double taxation for foreign companies

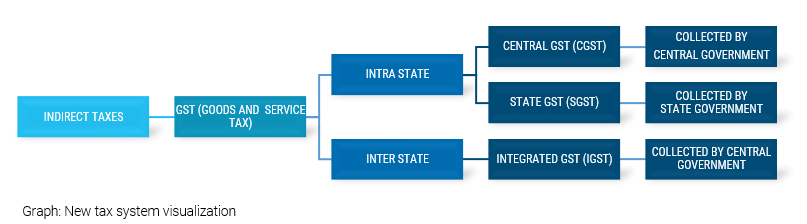

Last summer, India´s taxation system went through an enormous transformation. This manoeuvre took almost a decade for it to be ready for implementation, and it officially became effective only in the July of 2017. The government´s main intention was to increase the system´s transparency and productivity, and to simplify the previous tax structure, which was considered one the most complex in the world. In fact, it was comprised of a labyrinth of taxes at both national and state levels, which overlapped and applied different scales of components and rates. As a result, there was often the case of double imposition, which forced companies to bear considerable costs. Therefore, the new tax system, has reconnected all taxes under the same big umbrella, and the use of GST (Goods and Services Tax) has the ability to decrease complexity and preventing double taxation. In addition, the reform has the ability to produce higher tax revenues in the long run.

Fact 2: The territoriality principle is essential to the Indian tax system

The reform deeply affects the enterprises´ business transactions and, other important organizational aspects. For instance, before the government´s amendment the supply chain networks were structured accordingly to the favourable tax conditions from intra and inter states. However, were rearranged to take advantage of the new tariffs. This brings to light the importance of the territoriality principle, which is essential to the Indian tax system. Taxes are collected by both Central Government and State Governments, depending on either the location of the supplier of goods, or in case of services, the location of the receiver of the service.

Fact 3: The GST means a technology move

One of the most evident changes in the system consists in its complete automation. In fact, companies that still rely on manual invoicing are now forced to shift to software-based solutions. Incidentally, Deb Deep Sengupta, Managing Director of SAP India, notices how the GST represents a technology move, rather than a simple tax reorganisation, as it opens up huge opportunities for all cloud-based GST billing software providers.

Fact 4: Companies need a new SAP tax procedure

Nevertheless, even though the new tax system led to easier administrative operations, the shift to it has been a hurry for many businesses. In fact, another consequence of GST is that businesses have to update their software in order to comply with GST. More particularly, companies using TAXINJ have to migrate to the new SAP tax procedure, TAXINN. The second step was then to shift to GST, by migrating the GST patch to TAXINN and applying the SAP note for GST. The current localized system enables companies to handle transactions more easily and, most importantly, allows for simple tax or tax rate modifications and additions.

Nowadays, all enterprises running SAP software solutions have already undertaken the transition phase. However, for current and future implementations, the need to extend the SAP system to include Indian operations persists. In other words, companies must implement GST together with the SAP system. Satya Dev Bommireddy, Principal & Managing Director from Answerthink (A Hackett Group’s company) who has shared experience with United VARs in the Indian market, confirmed that nowadays the biggest challenge is to keep pace with an ever-evolving GST regime. In the wake of dynamic changes that are being proposed by the Indian government, companies should partner with system integrators with the right agility and localisation expertise to help them adapt to changes around rates, processes and systems, so they are able to fully gather multiple benefits that the GST offers and to ensure tax compliance.

Fact 5: The GST ongoing adjustments affect a company's whole supply chain

Before implementing an SAP solution, the areas of impact from the GST must be carefully considered, such as supply chain, accounting and reporting, technology, compliance, sourcing and distribution, profitability, finance, planning, pricing and sales. Engaging business experts as well as IT experts in the local team is simply mandatory to assure a smooth IT project execution.

Moreover, although GST has now been completely rolled out, there are still some issues that need to be finalized. In fact, there is the need to make some adjustments, and IT solution providers should prepare to be responsive when the government draws out the last changes. This month, one year after GST´s launch, further news of the changes in tax rates were released. Additionally, another announcement was India´s plan to establish one single GST submission from the beginning of 2019.

Fact 6: On-site support is crucial for every SAP rollout to India

Considering the future modifications of which the Indian taxation is subjected to, tax compliance remains quite a complicated task; even after simplifications have been put in place by the reform. Therefore, the implementation of solutions should be carried out with the help of a local partner, who has an extensive knowledge of the local tax system. In addition, involving local experts can be a crucial element during the SAP rollouts, as project management requires cultural skills that sometimes are missed by foreign IT solution providers, yet prove to be decisive in the change process and in the following stabilisation phase.

United VARs alliance: What a customer says

Among a variety of countries, a German based company “Rose Plastics”, recently conducted a rollout to India and implemented the GST. Rose Plastics worked with the German United VARs member All for One Steeb as a prime solution provider for the rollout, and cooperated with the local member company Answerthink for the rollout to India: “Both projects, the rollout to India and the GST implementation were realised in a very professional way from my point of view,” said Frank Hohensee, Head of IT at Rose Plastics. “The consultants involved in the projects were very experienced and highly motivated. The projects were running smoothly, and it was nice working together on these international projects. As a conclusion, I would fully recommend the Answerthink team to anybody doing a SAP project in India.” All for One Steeb and Answerthink are both members of the United VARs alliance, and are cooperation partners for global SAP implementations.

___________________________

Next article of the blog series "Rollout to the BRICS Countries" // South Africa:

Blog: South Africa's Latest Software Industry Trends

stronger than one